Nonprofits face a constant balancing act: how to empower staff and project leads with the autonomy to make purchases, while maintaining the controls needed for financial compliance. When spending tools are too rigid, teams are slowed down. But when they're too flexible, nonprofits risk overspending, lost receipts, audit issues, and budget blowouts.

Unfortunately, traditional expense systems aren’t built with nonprofits in mind. Generic business credit cards and manual reporting workflows create more problems than they solve, especially for organizations managing multiple programs or grant-funded initiatives.

Why Traditional Expense Management Methods Fail

Most corporate card systems were designed for for-profits—not mission-driven organizations that manage complex fund restrictions and grant reporting. Without purpose-built nonprofit controls, organizations are left with:

- Generic cards that offer no built-in safeguards to prevent misuse

- Delayed reconciliation and unclear expense ownership

- Increased risk of noncompliance during audits or funder reporting

Finance teams often scramble to track who spent what, for which project, and whether it aligned with donor or grant restrictions. These gaps increase risk and erode the financial clarity that nonprofit leaders need.

Credit Cards vs. Debit Cards: What’s Better for Nonprofit Expenses?

Credit cards can seem appealing: they offer flexibility, convenience, and widespread acceptance. But they also introduce risk, especially in nonprofit settings where oversight and compliance are critical. Unchecked spending can lead to debt, unapproved purchases, and complex post-hoc reconciliation.

Nonprofit-specific debit cards are a better fit. They draw directly from assigned project sub-accounts—so spending is limited to what’s been budgeted. With built-in rules and controls, they eliminate the risk of debt and automate compliance.

These cards let you define spending limits, set per-card budgets, and freeze or flag transactions that don’t align with funding restrictions. That means no more guesswork or retroactive clean-up.

How Nonprofit Debit Cards Provide Both Control and Flexibility

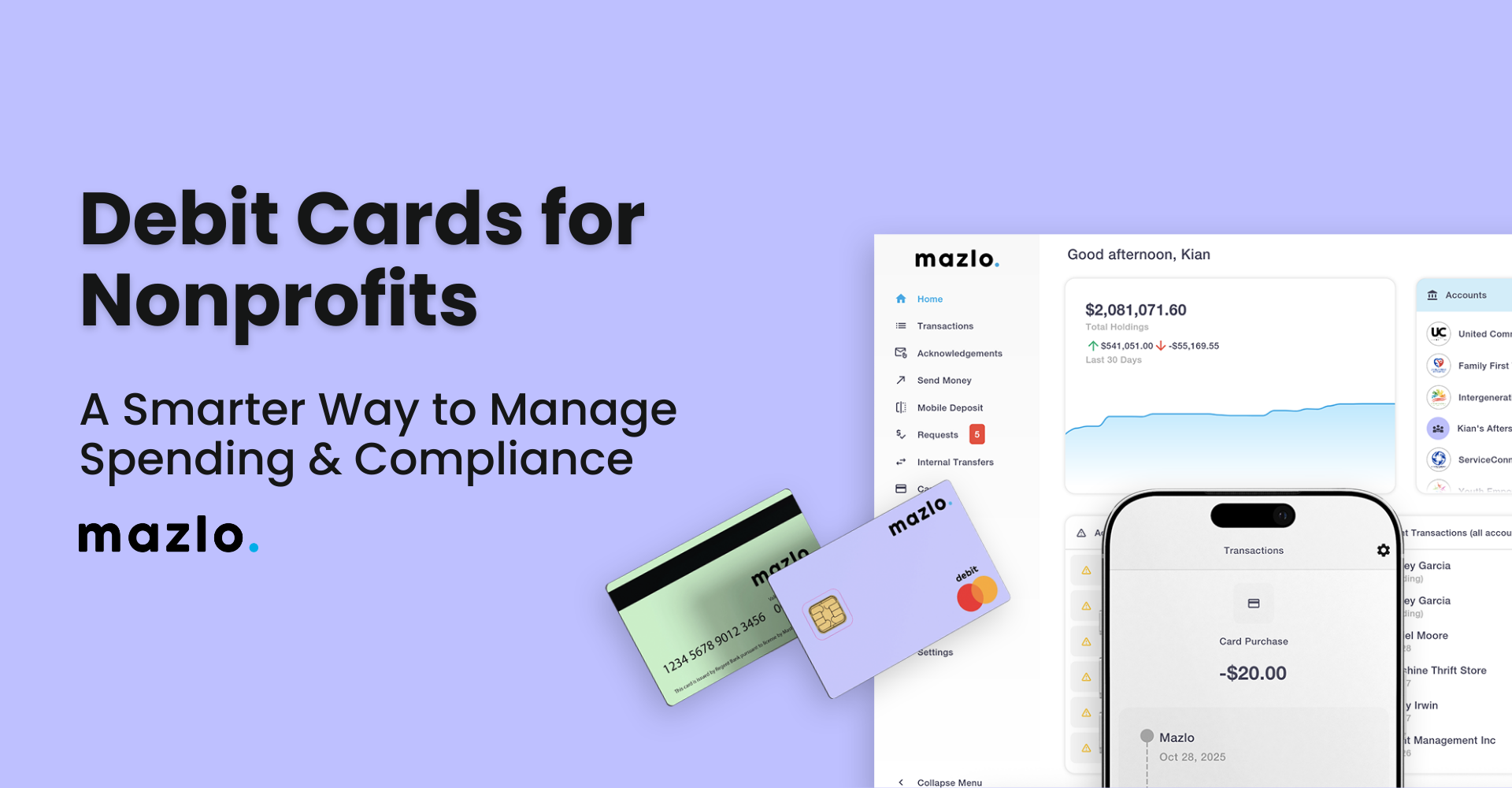

Mazlo’s nonprofit debit cards eliminate the traditional trade-off between control and autonomy. Your team gets the purchasing power they need, while finance and compliance leads retain real-time oversight. By replacing manual tracking with automated guardrails, nonprofit debit cards streamline expense management without sacrificing accountability.

Customizable Spending Rules

Mazlo’s platform lets you set detailed rules for how, where, and when funds can be used:

- Set card-level spending limits and project-specific budgets

- Automatically freeze cards or flag noncompliant purchases

- Minimize the need for constant manual oversight

This helps organizations maintain control at scale—even when managing dozens of programs or hundreds of users.

Virtual & Physical Cards

Issue virtual or physical debit cards for every team member, program lead, or vendor. Each card can be tied to a specific fund or project. Virtual cards are compatible with Apple Pay and Google Wallet, giving users the flexibility of digital payments with the safety of heightened controls. Physical cards can be issued for in-field work or staff with ongoing purchasing needs.

Built-In Accountability & Real-Time Visibility

Every transaction on a Mazlo card is traceable. You can:

- Require receipt uploads on purchases

- Freeze cards if expenses go over budget or documentation is missing

- Ensure each purchase is tied to a project or funding source

- See every transaction as it happens, with automatic audit trails

This level of transparency ensures spending aligns with donor intent and organizational policy without slowing down your team.

How Mazlo Makes Nonprofit Spending Simple, Compliant and Secure

Mazlo’s debit cards are purpose-built for nonprofits and fiscal sponsors. Whether you’re managing 3 projects or 300, Mazlo makes it easy to control spending, meet compliance standards, and empower your team.

- Sub-accounts keep project funds separate and protected

- Built-in rules ensure grant and donor restrictions are respected

- Real-time tracking replaces manual reconciliation

- Integrations with accounting systems keep data audit-ready

For organizations juggling multiple programs, restricted funds, and tight reporting deadlines, Mazlo offers a smarter, more secure way to manage day-to-day expenses.

Explore Mazlo debit cards for nonprofits and discover how we help mission-driven organizations spend with confidence.